How Do You Know When To Buy Or Sell In Forex

Candlestick Reversal Patterns

Most forex traders that utilise technical assay every bit the basis for their positions spend a lot of fourth dimension watching candlestick charts. This chart type is useful on a number of different fronts, and i of the best examples of this tin can be institute in the means candlestick charts tin make it easier to spot reversals.

When we talk about reversals, the main idea is that any prevailing trend has started to accomplish its exhaustion point and that prices are set up to start moving in the opposing direction. In the moment, it might seem very difficult to know that all of the previous directional momentum has actually run its course. But when we use candlestick formations as an identification tool, at that place are some specific signals that are sent on a regular footing. Here, we volition look at various formations of the doji, also equally the bullish and surly engulfing patterns.

Doji Pattern

The doji candlestick pattern is a strong reversal betoken that shows market momentum is running out. Since the bulk of the ownership or selling activity has already taken place, any indication that the number of bulk participants is dwindling tin can be used equally an opportunity to start taking forex positions in the other direction. The doji blueprint can exist bullish or surly in nature, all depending on the direction of the previous trend.

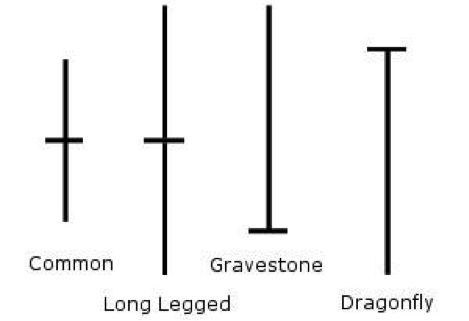

Allow's take a wait at the structures of the doji blueprint:

Chart Source: Forexmachines.com

The candlestick formations shown above might look dissimilar in grade, but they all essentially tell the same story. The common doji pattern is composed of a very small-scale candle torso with an upper and lower wick. The long legged doji also has a very small candle body that is roughly in the center of the formation. In this case, still, the upper and lower wicks are longer which ultimately suggests that there was more volatility during that time interval.

The gravestone doji is one of the most bearish versions of the pattern. In this case, the pattern shows a very small-scale candle body at the bottom, with a long wick to the topside. This pattern shows that markets rose quickly to levels that were unsustainable. Sellers and then took over and the time interval concluded. If this formation is followed past a full-bodied surly candle, confirmation is in identify and curt positions tin be taken.

The dragonfly doji is ane of the well-nigh bullish versions of the pattern. In this case, the pattern shows a very minor candle trunk at the top, with a long wick at the lesser. This pattern shows that markets fell to levels that were unsustainable. Buyers so took over and the fourth dimension interval ended. If this formation is followed by a full-bodied bullish candle, confirmation is in place and long positions can be taken.

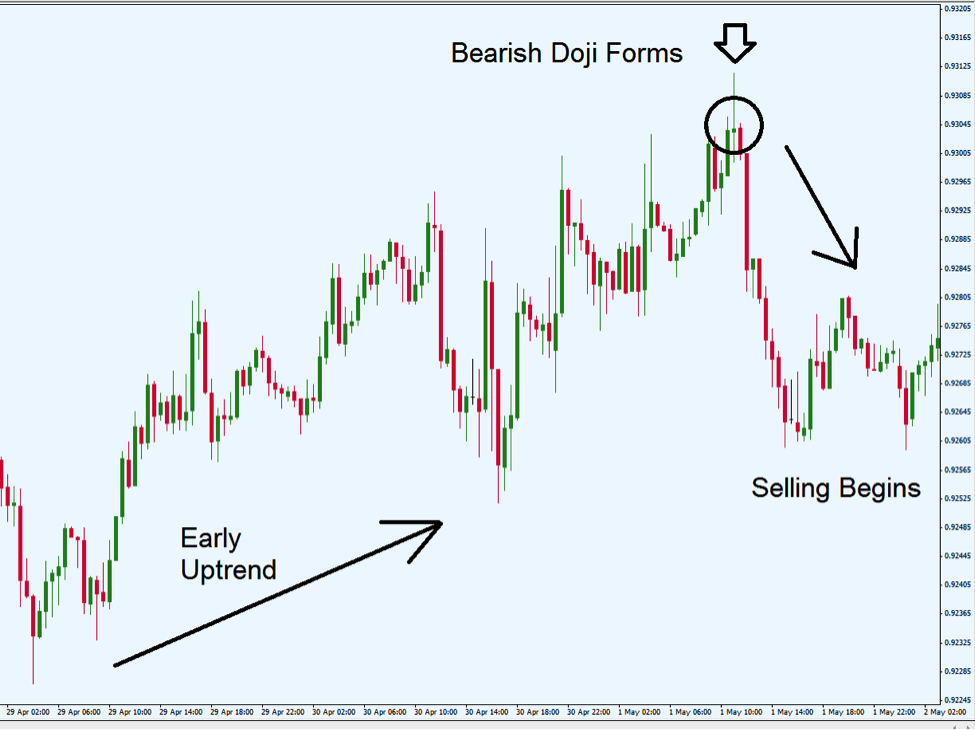

Let'due south have a look at an example of a surly doji pattern in a real-fourth dimension AUD/USD nautical chart:

Nautical chart Source: Metatrader

In the chart to a higher place, we tin see that price activity was strongly bullish in the AUD/USD. Merely no trend tin terminal forever, and market place momentum starts to dull as process rise to a higher place the 0.9300 area. Hither, a surly doji pattern forms — suggesting that the previous balderdash tendency is ready to reverse. After the doji is seen, a strong bearish candle forms, confirming the reversal pattern. Short positions could have been taken at this stage, and forex traders could have then capitalized on all of the downside movement that followed.

Bullish and Bearish Engulfing Patterns

In terms of candlestick formations, the doji pattern is relatively extreme and requires strict definitions for what can be seen in the body in order to be valid. Only there is another pattern shape that is less rigid but simply as powerful in the ways information technology can predict trend reversals. Next, we await at the bullish and bearish engulfing pattern, which is another candlestick indicator that can be used in establishing forex positions.

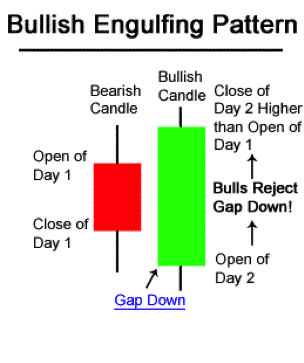

The following shows the construction of the bullish engulfing pattern:

Source: OnlineTradingConcepts.com

In the bullish engulfing design, a downtrend is seen coming to an finish. Downtrends are dominated by bearish candles, and a small-scale bearish candle is what is needed to start the bullish engulfing pattern. This small bearish candle is then followed by a larger bullish candle that overwhelms, or engulfs what was seen previously. In the graphic above, nosotros can see that the starting time candle body is roughly one-half the size of the bullish candle body that follows. Markets initially push button prices lower, and this downward gap creates a lower wick that extends beneath the initial bearish candle. Market momentum then reverses, extending to a new higher loftier and a strong positive shut that is higher on Day 2.

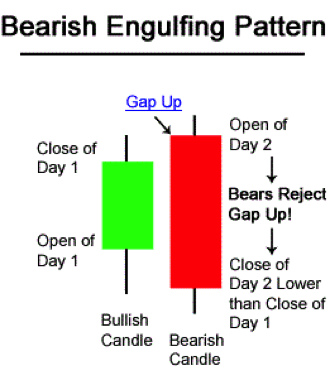

The following shows the structure of the surly engulfing design:

Source: OnlineTradingConcepts.com

In the bearish engulfing blueprint, an uptrend is seen coming to an end. Uptrends are dominated by bullish candles, and a minor bullish candle is what is needed to first the surly engulfing pattern. This small bullish candle is and then followed by a larger bearish candle that overwhelms, or engulfs what was seen previously. In the graphic higher up, we tin meet that the first candle torso is roughly one-half the size of the bearish candle trunk that follows. Markets initially push prices college, and this upward gap creates a higher wick that extends beneath the initial bullish candle. Market momentum then reverses, extending to a new lower low and a strong negative close that is lower on Twenty-four hour period 2.

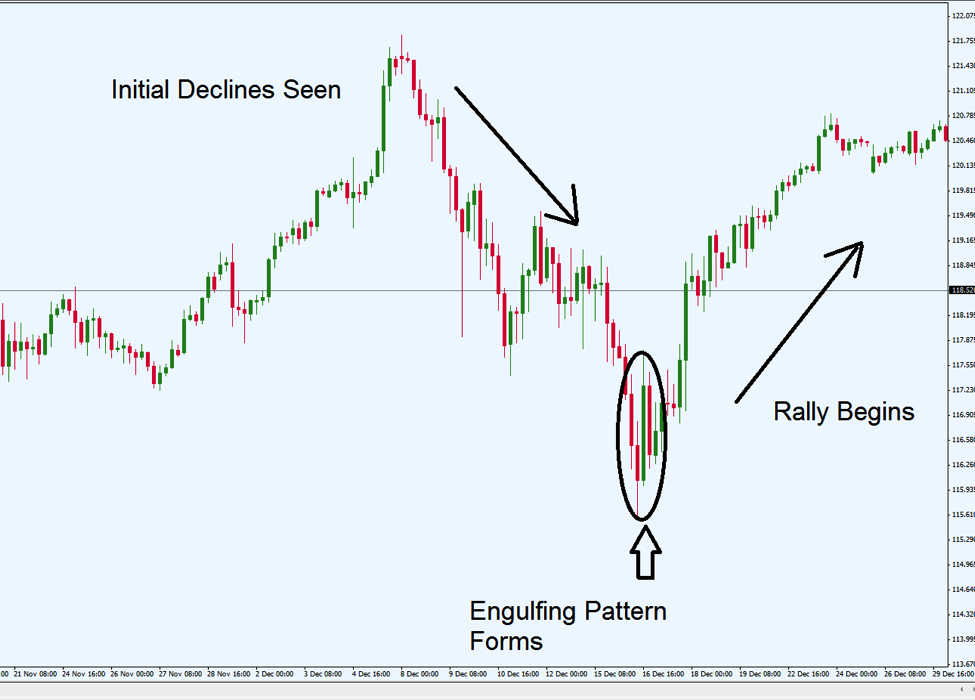

With this in mind, consider the USD/JPY chart beneath:

Chart Source: Metatrader

Which type of engulfing pattern is present hither? Since the initial trend is downward and then we later on come across a bullish reversal, the blazon of structure here is the bullish engulfing pattern. Here, we can run across that prices autumn to roughly 115 — and the series of small red candles is concluded by a potent dark-green candle that suggests a reversal is imminent. Forex traders could take taken long positions hither, and capitalized on the gains that followed.

Deport Trades

The forex market is associated some a few trading strategies that cannot be found in other asset classes. 1 example tin can be seen in the carry merchandise, which benefits from differences in involvement rates that can be found when pairing currencies together. All forex positions involve the simultaneous buying and selling of ii different currencies.

When traders buy a currency with a high interest rate in commutation for a currency with a lower interest charge per unit, the interest rate differential accumulates on a daily basis. Over time, these positions tin become quite profitable as the carry value of these trades is essentially guaranteed (as long as the interest rate differential remains intact). For these reasons, at that place are many traders that choose to focus exclusively on these types of strategies. Hither, we will await at some examples of hypothetical deport trades in guild to see how profits can be captured over fourth dimension.

Currencies and Interest Rates

All currencies are associated with a specific interest rate. These rates are determined by the central bank in each nation. This is why monetary policy meetings at key banks are viewed with a high level of importance by forex traders. When you buy a currency, you gain the interest rate for as long as you concur the position.

For example, if the European Cardinal Bank has set its criterion involvement rate at 2.v%, y'all volition proceeds ii.5% on your position for each twelvemonth yous agree that currency. If yous were to sell the currency (ie. in a short position in the EUR/USD), your forex account would be debited -two.5% for each year you concur the position. In all cases, these credits and debits volition accumulate daily one time the position is held through the rollover period at 5pm.

Trading Examples

Let's consider a few hypothetical trading examples using the carry merchandise rationale. Historically, the Australian Dollar (AUD) has been associated with high interest rates while the Japanese Yen (JPY) has been associated with depression interest rates. For this reason, the AUD/JPY is one of the most popular options for carry trades.

Hypothetically, let's assume that the Bank of Commonwealth of australia has set its base interest rate at 5%. Let'due south also assume that the Bank of Japan has fix its base of operations interest rate at 0.5%. The interest charge per unit differential for these ii currencies would then be 4.5%, so if y'all were to buy the AUD/JPY and agree the position for i year you would earn a guaranteed four.5% on your position. This would be independent of any changes seen in the underlying exchange charge per unit between these two currencies.

Negative Carry

As a signal of illustration, it should as well be understood that carry value tin too work in the reverse direction. Let's assume that the Federal Reserve has fix the interest rate for the U.s. Dollar at 3.v%. At the same time, the Bank of Canada has set the interest rate for the Canadian Dollar at 2%. What would occur if you chose to accept a short position in the USD/CAD?

A brusk position in the USD/CAD would mean that you are selling the USD and buying the CAD. Since you would exist buying the currency with the lower interest charge per unit, your position would be exposed to negative carry — which in this example means that your trading account would be debited a value equal to -i.5% of your position for each year the position is held. This is because the involvement rate differential betwixt the USD and CAD is 1.five% (3.five% and 2%). Because of this, long-term positions that are associated with negative deport are exposed to greater gamble because the losses are guaranteed. Whatsoever profits that might be generated by potential changes in the underlying substitution rate would still need to account for the behave costs incurred during the life of the position.

Long-term Positioning

Forex traders that utilise bear merchandise strategies tend to be traders that possess a long-term outlook. This is because it commonly takes a bang-up bargain of fourth dimension in order to generate sufficient profits to justify the position. The interest rate values that are quoted by your forex broker are given on a yearly basis. This does not hateful that you will exist required to hold your positions for a full twelvemonth in order to capture the benefits of the comport trade. All positions are pro-rated, and your concluding profits and losses will be determined past the exact length of time yous held each position.

Nigh forex traders in the advanced stages of their career tend to identify the majority of their focus on the currency market. At that place is expert reason for this, as it allows for greater familiarity within a specific asset class. But one problem with this approach is the fact that it becomes very easy to forget that all markets are interconnected and greatly influence one another.

Forex is certainly no unlike, and then it makes sense to have an agreement of the ways areas similar stocks and commodities work with (and against) currency markets. Here, nosotros volition look at some of the factors that drive correlations between forex and the other major asset classes.

Stock Benchmarks

Individual stocks take little to no influence on the forex markets, merely this is not the example when we look at the benchmark indices as a whole. Closely watched instruments like the S&P 500 or the FTSE 100 tin can have a significant influence on currencies — especially the currencies that are most closely associated with those geographical regions.

Strongly bullish days in the German DAX and French CAC 40 tend to back up forex pairs like the EUR/USD and EUR/JPY. Positive activity in the Nikkei 225 tend to create selling pressure in the forex pairs denominated in the Japanese Yen (equally the JPY is the counter currency in these pairs). Prices changes in the GBP/USD will ofttimes be influenced past the FTSE 100, and many forex traders will await to meet the prevailing trends in each of these benchmarks before establishing brusk-term positions.

In the case of the U.s.a. Dollar, things tend to work in contrary. Since the USD is more often than not considered to be a safe oasis asset, it will ofttimes merchandise in the opposite direction relatively to the central benchmarks in the US — the S&P 500 and the Dow Jones Industrials. This means that on negative stock days, traders tend to accept their money out of stocks and store it in cash. This benefits the USD and shows that there is a negative correlation relationship betwixt the currency and its nearly closely associated stock benchmarks. And then days that are strongly bullish for the S&P 500 and the Dow Jones will more often than not create a more than negative outlook for the USD.

Commodities

Commodities markets will affect forex prices in different ways. Countries that are known for metals production tend to benefit when the price for those assets is increasing. For example, there is a large amount of copper production in Commonwealth of australia. On days where copper prices are ascension, currency pairs like the AUD/USD tend to benefit. In the same way, loftier levels of gold production in Canada create a positive correlation between the price of gold and the CAD. On days where gilded prices are rise, currency pairs like the CAD/JPY tend to rise (and vice versa).

At the aforementioned time, the USD tends to work in the opposite management. This is considering bolt are priced in United states of america Dollars, so traders will generally need to sell Dollars in club to purchase gold or oil. If you encounter a trading twenty-four hours where oil is rallying, there is going to be at least some downside force per unit area placed on the USD as the broader lodge flow that is seen in the market will require extra sales of the Dollar.

Conclusion: Remain Cognizant of Trends in Alternative Markets

For all of these reasons, it makes sense to remain cognizant of trends in other asset classes — even if it seems like there is no direct connection between your forex trade and the latest price moves in stocks or bolt. For the nearly office, what you should exist looking for are negative and positive correlations, so watch what is happening in alternative markets before you place whatsoever new forex positions.

These correlations alone might not be enough to use as a sole footing for new positions. Just these are factors that should be considered, as in that location are clear influences that tin be measured. Having a firm agreement of the broader interconnection between these markets can help you turn your probabilities for success back into your favor over the long run.

Diversifying A Forex Portfolio

Most with experience trading in the financial markets understand that diversifications is generally a adept thing. When we think of diversification, it is usually associated with stock investments that are spread over a number of dissimilar industry sectors. But it is possible to diversity your forex portfolio, as well. This tin can exist done by separating currencies into dissimilar categories and making sure that you are not "doubled-upwardly" on any ane nugget. Here, we will wait at some of the factors that go into diversifying a forex portfolio.

Avoid Doubling-up

Commencement, it must be understood that having multiple positions in a unmarried currency tin can be peculiarly problematic. For example, permit's presume a forex trader buys one lot in the EUR/USD and one lot in the EUR/GBP. It might seem as though the trader is taking two entirely dissimilar positions, but nothing could exist further from the truth. In a scenario like this, the forex trader would substantially be taking a double position in the EUR — even though it is being washed against two different currencies. Here, the trader would substantially exist "placing all the eggs in one handbasket" and would exist peculiarly vulnerable if whatever weakness is seen in the Euro.

In a case like this, it would be much wiser for a trader to take a one-half-position in both of these currency pairs, as this would limit the excessive exposure in the Euro currency. Taking on excessive exposure in any unmarried currency can be very dangerous, and break many of the basic forex rules that require proper merchandise management. There is nothing wrong with separating your stance across more than one currency pair. Just proper trade direction rules dictate that no forex position should expose your account balance to losses of more than 2-three%. So if you are looking to express your market views using more than one currency pair, it is important to avoid taking full-sized positions that purchase or sell a single currency. This is non much unlike than taking two positions in 1 pair, every bit any downside action in the currency y'all are ownership will effectively generate twice the losses.

Watch Currency Correlations

Another cistron to consider is the currency correlation. Many currencies tend to autumn into the same category, and if yous are looking to attain diversification in your forex portfolio, yous will need to create exposure to more than than ane asset type. For example, the Us Dollar (USD) and Swiss Franc (CHF) both autumn into the rubber haven category that benefits from economic uncertainty and failing stock markets. The Japanese Yen (JPY) is another currency that benefits from these types of scenarios equally forex traders will oft look to close out conduct trade positions.

Other examples include traditionally loftier-yielding currencies like the Australian Dollar (AUD) and New Zealand Dollar (NZD). At the same time, the Euro and British Pound (GBP) tend to move in similar directions, given the interconnected nature of both economies.

Achieving Diversification

With all this in mind, forex investors with a long-term outlook should look to spread their portfolio beyond more than one currency type while avoiding doubling-up on whatever one position. For example, forex investors might expect to create some exposure to high yielding currencies while withal maintaining long positions in a condom haven currency in guild to protect against unexpected shocks in the market place. In this way, modern portfolio theory can exist applied to markets other than stocks and it can be used to smooth volatility in your collective positions.

Forex traders should be looking at their portfolios as a collection of positions, rather than a vehicle for ownership a single currency in multiple pairs. When yous play to the strengths of multiple forex types, it becomes much easier to harness the positives that are seen each currency form. At the very least, it must be remembered that truthful diversification cannot be achieved using more than one total position in a single currency. Information technology is possible, withal, to take a majority position in 1 currency while using reduced position sizes. In the initial example presented hither, a trader would be much more than secure and protected from risk if the EUR positions were reduced. This could mean reduced positions across pairs like EUR/USD, EUR/GBP, and EUR/AUD.

Forex Algorithmic and Quantitative Trading

Nosotros have seen many new trends in fiscal trading over the last decade. One of those is the fact that Forex trading became popular as the internet became more than widespread. Simply forth with this has been an increased trend in calculator-based trading that allows for the implementation of automated strategies. For the near part, these trades are based on predetermined technical assay strategies that have been back-tested and proven successful over time.

That said, automatic trading does involve some level of gamble and there are many black box packages that promise significant returns over a short period of time. Whatever extreme promises similar this should be met with at least some level of skepticism. But the fact remains that algorithmic and quantitative trading is a valid part of the forex market — and this volition not exist changing whatever fourth dimension shortly. Here, we expect at some of the factors that should be considered before placing algorithmic trades that are based on quant strategies.

Algorithmic / Quantitative Strategies Divers

First, traders must sympathize what is meant by algorithmic and quantitative trading. Specifically, these terms refer to instances where forex traders initiate positions that are divers by predetermined mathematical formulas. For example, trades might be triggered when prices rise above or below a certain moving average. Factors like price momentum, standard deviation, historical averages and tendency force tend to be used equally a basis for most of these strategies. Once a specific prepare of criteria are met, trades are placed — and this can fifty-fifty include added elements like the placement of stop loss orders and profit losses.

Practiced Advisors

To trigger these trades automatically, forex traders will generally utilize an Adept Counselor, or EA. This can be done using a forex trading platform that allows for automated trading. Some of the most common choices hither include TradeStation and Metatrader, which are both highly customizable platform that allow for algorithmic and quantitative trading. So if you are interested in actually using this type of strategy, you will want to make sure that you use a forex broker that offers platforms like these or something similar.

When looking for the EAs themselves, the options are much broader. To go some perspective, your forex trading platform can be thought of as your calculating device and the EAs that you lot utilise can be thought of equally an app. These apps volition trigger trades automatically — equally long as your predetermined market criteria are met and your trading station is open and working. EAs can exist found through a uncomplicated web search, merely some sources for these are certainly more reputable than others. It is often better to use EAs that tin can be institute through forex trading communities, as these can be considerately tested and reviewed. Without this added security, it is sometimes difficult to know whether or not the EA has been accurately back tested and is truly capable of producing its claimed results. Two popular sources for EAs can be establish at Forex Peace Army and Forex Manufacturing plant. Many of the EAs listed on these sites are gratis of charge.

Pros And Cons

Every bit we said before, automated forex trading is associated with its own set of benefits and drawbacks. On the positive side, algorithmic and quantitative strategies allow forex traders finer monitor all aspects of the forex market — even when they are not actively monitoring their trading station. Call back of it this manner, you might have a highly successful strategy but it would be impossible to lookout man every forex pair for instances where your predetermined criteria are met. Calculator-based strategies have that capability and this can allow you to capitalize on forex trades that you might accept missed otherwise.

On the negative side, you volition nigh certainly encounter instances where your EA has opened a merchandise that you might have avoided yourself. Unfortunately, computer algorithms are digital models that are meant to understand an analogue world — and there will be instances where your EA model will open positions more aggressively than you might take on your own. For these reasons, it is generally a good idea to keep your forex position sizes smaller than y'all might when yous are trading manually.

On the whole, it is best to expect at your success rates over fourth dimension and then stay with a given EA if information technology produces positive results that are consistent. Algorithmic and quantitative trading is non something that should exist undertaken in a haphazard way, as it could open up your trading account to potential losses. Merely if these strategies are properly researched (and accurately back tested), automated strategies can be a powerful tool to add together to your forex trading arsenal.

Forex Momentum Oscillators

In lodge to make money in the forex market place, you will need to have some way of forecasting where prices are likely to caput in the future. One of the best ways of doing this is to make an assessment of where the majority is the market place's momentum is placed. There are many ways of doing this but technical analysts tend to take an border in these areas with the help of some proven charting tools. Ii of the nigh popular choices can be constitute in the Momentum Oscillator and the Relative Strength Index (also known as the RSI). Here, we will look at some of the ways forex traders use these tools and and so provide some visual examples in agile currency charts.

The Momentum Oscillator

When looking to assess the dominant momentum seen in the forex marketplace, a good place to look is the Momentum Oscillator. This charting tool enables forex traders to measure the charge per unit of change that is seen in the closing prices of each fourth dimension interval. Slowing momentum can be an excellent indication that a market place tendency is ready to reverse. When reversal points are accurately pinpointed, forex traders are able to "buy low and sell high" before the residue of the market has fabricated the transition.

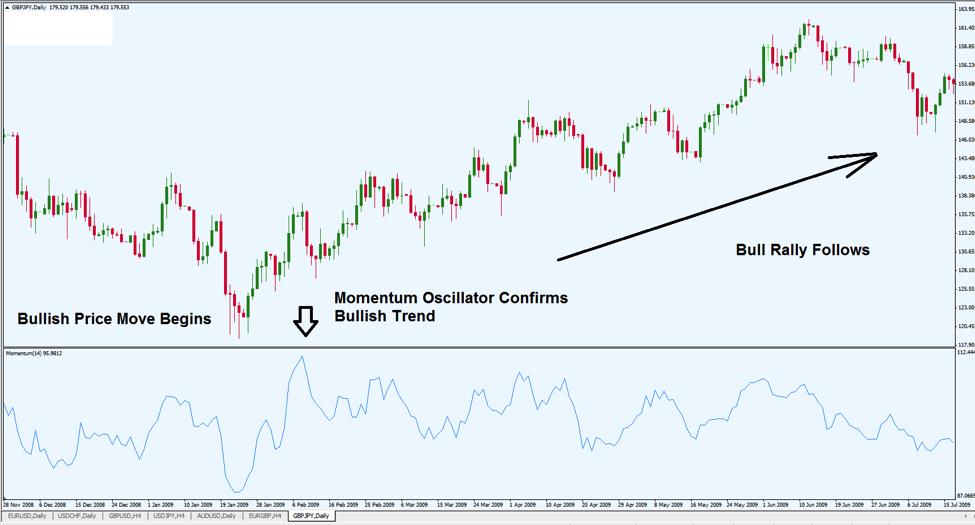

In brusk, traders should side with the ascendant trend when the Momentum Oscillator indicates strengthen. Traders should bet confronting the tendency when the Momentum Oscillator slows and suggests that the market place is reaching a point of exhaustion. Allow's take a look at a real-time chart example using the GBP/JPY:

Chart Source: Metatrader

Hither, the Momentum Oscillator is plotted beneath the price action and shown in blue. A rising line suggests that market momentum is edifice. When the momentum line falls to the lesser of the measurement, momentum is leaving the market.

In this instance, we tin meet that prices fall to their lows near 119.20. Prices then brainstorm to rise and this is accompanied by a strong tendency bespeak sent past the Momentum Oscillator (shown at the first arrow). This would be in indication for forex trader to side with the direction of the latest price movement — which, in this example, is bullish. The GBP/JPY then experiences a massive rally above the 160 mark. In this example, a forex trader could have seen the early signals sent by the Momentum Oscillator and initiated a long position in the GBP/JPY. If this was washed, significant profits could have been realized with little to no drawdown.

The Relative Forcefulness Index (RSI)

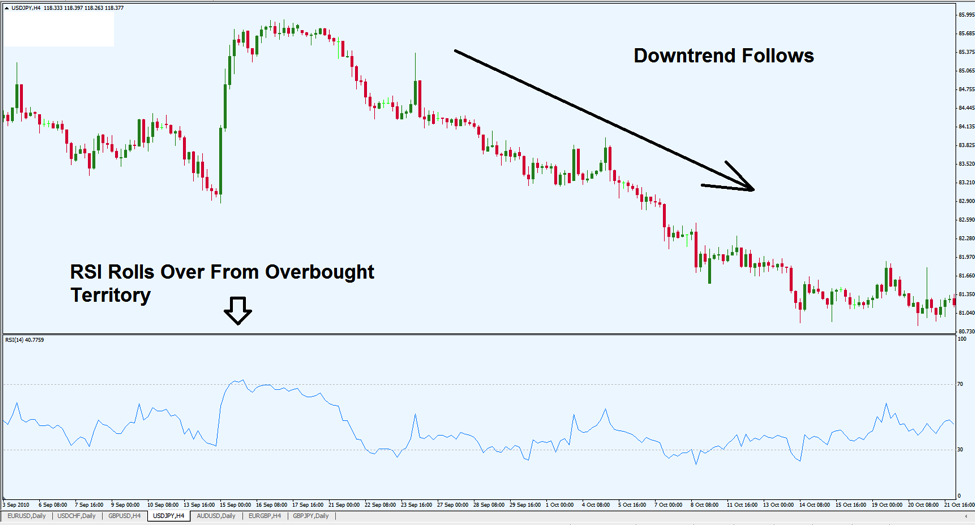

Some other choice for measuring momentum in the forex markets is to use the Relative Force Index, or RSI. This chart tool compares recent gains and losses to determine whether bulls or bears are truly in control of the market. Side by side, we volition look at a charted RSI example using the USD/JPY:

Chart Source: Metatrader

The RSI ranges from 0 to 100. Indicator readings above the 70 mark are considered to exist overbought, while readings below the thirty mark are considered to be oversold. Buy signals are generated when the indicator falls below the 30 mark and and then motility back above that threshold. Sell signals are generated when the indicator rises above the lxx mark and then motility back below that threshold.

In the USD/JPY example above, nosotros can encounter that the requirements for the bearish opinion are met as the indicator hits overbought territory before the RSI reading starts to plough lower. Equally this occurs, the USD/JPY is trading at 85.eighty. Ultimately, the pair falls to 80.90 before turning back upward, which means that any trader acting on the momentum signal generated by the RSI sell signal could have captured nearly 500 pips in profit with very little drawdown. In this way, the RSI tin be a highly effective tool is assessing whether market momentum is likely to exist bullish or surly in the hours, days, and weeks alee.

Forex traders looking to plant positions based on the underlying momentum nowadays in the market can benefit greatly after consulting the RSI, as it is a quick and easy way of assessing whether or non market prices have go overbought or oversold.

Forex News Trading

Forex traders that are looking to base their positions from the perspective of fundamental analysis will almost always utilise new releases in forming a marketplace stance. These news releases tin take a variety of unlike forms, simply the nearly common (and relevant) for forex traders is the economic news release. These reports are scheduled well in advance and are generally associated with marketplace expectations that are derived from analyst surveys. Economic data calendars tin be establish easily in a spider web search, one adept example can exist found hither.

In some cases, these expectations are accurate. In other cases, they are not. So it is important for forex traders to monitor developments in these areas, equally there are many trading opportunities that tin exist found once important news releases are made public. One of the best ways to approach this strategy is to await for significant differences between the initial expectations and the concluding results. When the marketplace is reacting to the new information, volatility spikes are seen and the large changes in prices can be quite profitable if defenseless in the early on stages.

Assessing Information Importance

Of course, not all economic releases are associated with the same level of importance. Reports like quarterly GDP, inflation, unemployment, and manufacturing tend to come up toward the top of the list. Merely at that place will be cases where other, more minor economical reports are more relevant for a specific scenario. For this reason, it is of import to avoid falling into a rigid routine when assessing which data reports are likely to exist of import and which are not.

One of the best ways to assess whether or not a given report will significant move the market is to merely spotter which upcoming reports are getting the near attending in the fiscal media. These reports tend to generate headlines in one case the results are finally made public, and financial news headlines will oftentimes dictate which trend is dominant on whatsoever trading day.

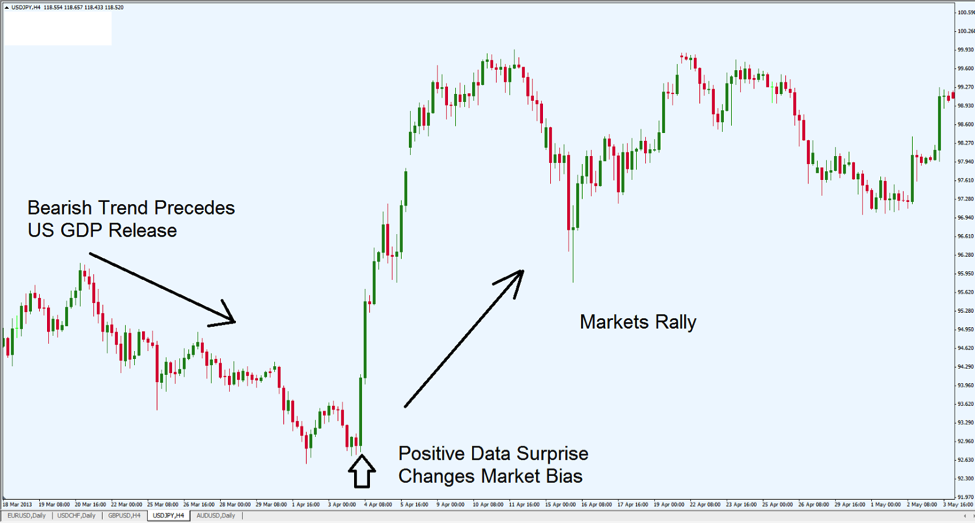

Existent-time Nautical chart Example

Permit'southward have a expect at a real-time chart example in the USD/JPY. In this case, markets were eagerly pending quarterly Gross domestic product figures out of the The states. Forex analysts were expecting a decline of -0.v% for the period, and this negative expectation sent the USD lower across the board. These trends forced the USD/JPY to lows near 92.seventy only prior to the data release.

Chart Source: Metatrader

Simply onces the report was really made public, it quickly became clear that the consensus estimate was wrong — and The states quarterly Gdp rose at a rate of i%. In the chart above, nosotros tin can meet that the market reaction was quite pronounced and overtly bullish for the USD. Prices somewhen rallied above the 99.l, driven largely by the changing market expectations for the overall outlook in the USD. Any trader that was actively watching the newswires during this release could have jumped in on this rally in the early stages and captured massive profits with little to no drawdown.

Scenarios like this happen all the fourth dimension. The reality is that it is quite difficult for forex analysts to accurately predict the results of economic system information in all cases. Macroeconomic information is influenced by a countless number of factors (both national and global in nature), then information technology is essentially incommunicable for forecasters to build mathematical models that can brand accurate forecasts every time. Just information technology is important to remember that these differences between expectation and reality are the instances that create the greatest opportunity in forex markets. In essence, large surprises create large price moves. And these price moves can be translated to large profits if caught in the early on stages.

Minimizing Risk

A final point to note is that news driven market place events tend to create extreme volatility in forex prices. This increment potential advantage also carries with information technology the increased potential for take chances, so information technology is absolutely essential for forex traders to make sure that any established position is placed using a protective stop loss. In most cases, news information tends to strength prices on one direction with very little to be seen in cosmetic retracements.

Just this will only work for positions that are taken in the direction of the data (ie. bullish positions for positive data, surly positions for negative information). It tin can be hard to place news positions chop-chop in some cases, so all orders must be placed to a good deal of care and attention. News trading can exist quite assisting when done correctly — but a certain level of caution is warranted, too.

Forex Technical Indicators

Technical analysis is a pop method used in the forex markets, as information technology allows traders to view cost activeness in objective means. This is helpful considering it allows traders to spot non positioning opportunities before big toll moves offset to take shape. It tin can be argued that technical analysis is fifty-fifty more pop in forex than information technology is in areas like stocks or commodities. So, for those looking to tackle the currency markets and achieve long-term profitability, information technology makes sense to take a solid understanding of the terms and strategies that are commonly used.

Since chart analysis has such an of import affect on forex trading, information technology is not surprising that nosotros see some technical indicators used that are less commonly known in other markets. Indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) take their identify in forex trading just as they do in stocks, commodities, and futures. Merely alternative indicators like Stochastics and Bollinger Bands are ii examples of charting tools that might exist less commonly known in the other financial markets. Hither, we volition look at ways trades tin be placed when using these technical indicators.

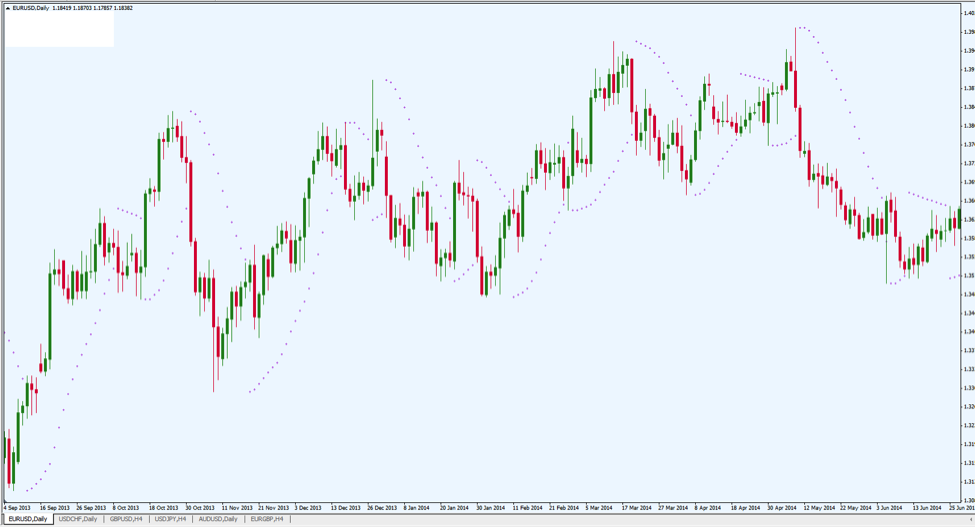

Bollinger Bands

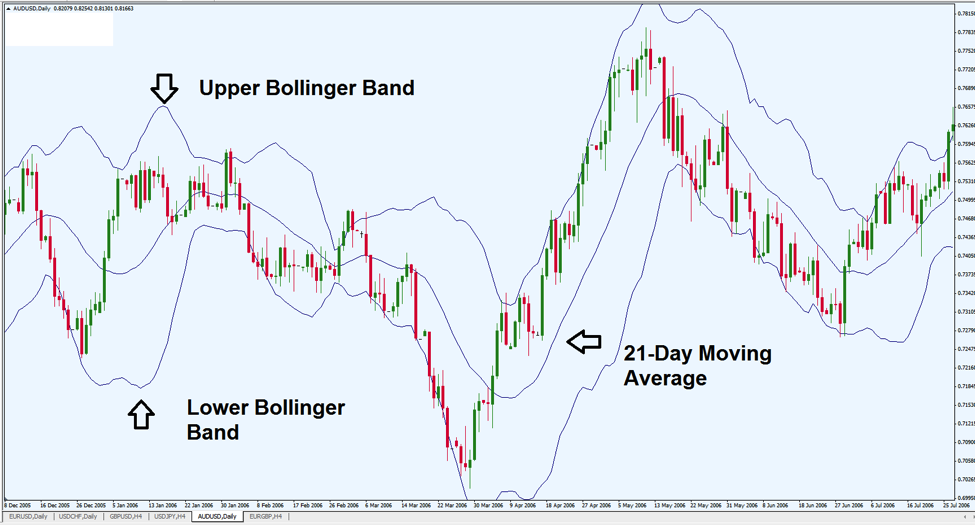

Bollinger Bands were developed past a famous chart technician named John Bollinger. They are designed to literally envelope cost action and give traders an thought of how far valuations might move if market volatility starts to increase. Let's have a await at a real-fourth dimension instance using the AUD/USD:

Nautical chart Source: Metatrader

In the example above, nosotros tin come across that Bollinger Bands are composed of 3 different lines that motion in tandem with price action. The upper ring can exist thought of every bit a resistance line, the lower band tin be thought of as a support line. These ii lines are then plotted along with a 21-period moving average, which is generally well-nigh the heart of the underlying price activeness. The upper and lower bands are placed two standard deviations away from price activity. These bands will tighten as market volatility declines, and then widen every bit market place volatility increases.

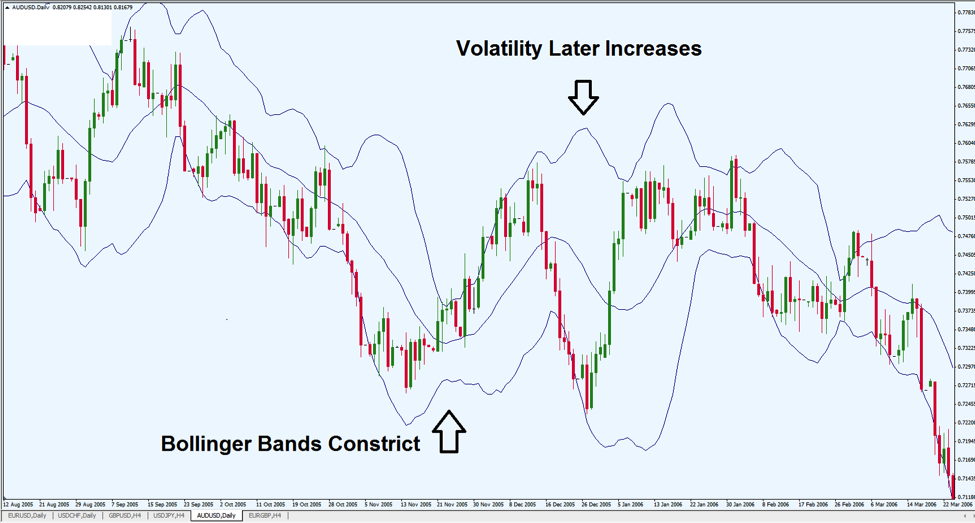

In terms of buying and selling signals, there are a few unlike points to annotation. First is that Bollinger Bands tin can exist great in predicting future volatility. Over again, we await at cost activity in the AUD/USD:

Chart Source: Metatrader

In the chart above we tin can run into that the Bollinger Bands constrict. This indicates a menstruation of indecision in the market every bit fewer traders are activeness buying and selling. Merely atmospheric condition like this can only last for so long. It might be that the bulk of the market is waiting for an important economic release, and once that data is made public volatility should start to increase in a relatively predictable management. Essentially, tight Bollinger Band readings suggest that the market is getting ready to make a big move (although the direction of that move is not yet apparent). Broad Bollinger Bands suggest the reverse, as excessive volatility volition probably kickoff to settle.

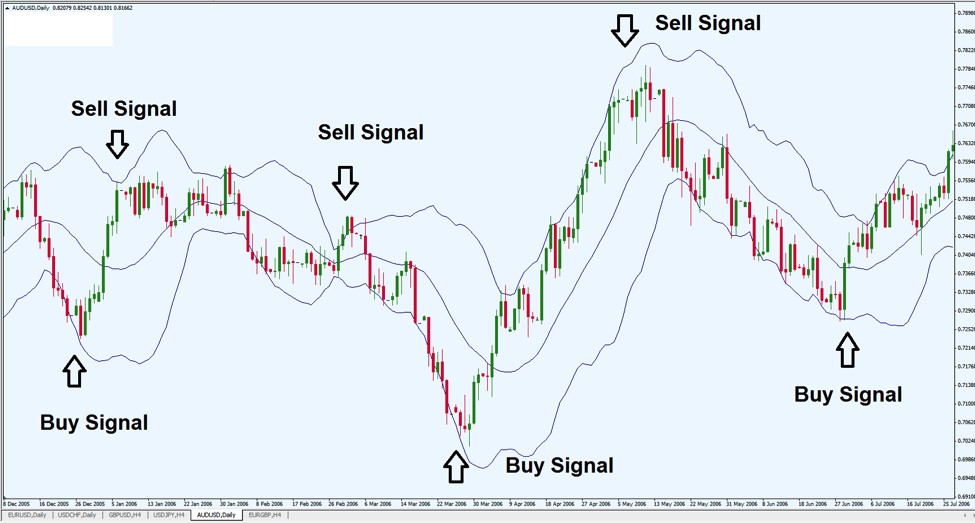

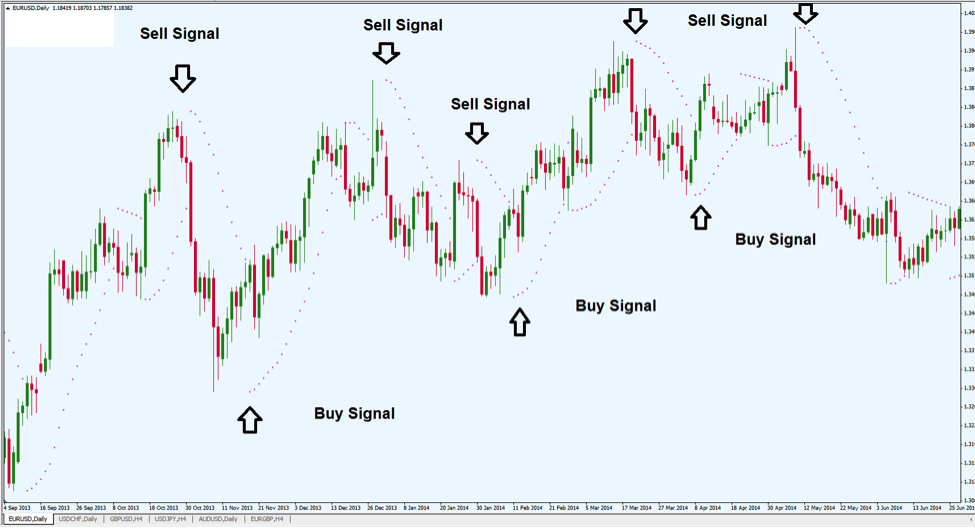

Next, we expect at means the Bollinger Band indicator sends buy and sell signals to the marketplace. Again, we look at the AUD/USD:

Nautical chart Source: Metatrader

In this chart instance, we tin can come across the various says that Bollinger Bands send buy and sell signals to the market. Since the upper and lower bands should be thought of as dynamic support and resistance levels, the currency should exist bought when prices autumn to the lower ring and sold when prices rise to the upper band.

This is true considering any time prices have reached the outer band, it shows that prices take now moved two standard deviations abroad from their historical average. Prices can only exist in these areas five% of the fourth dimension, and so when prices are seen in these areas a reversal should exist expected. For this reason, the currency pair should be sold when information technology rises to the upper band, and bought when information technology falls to the lower band.

Stochastics

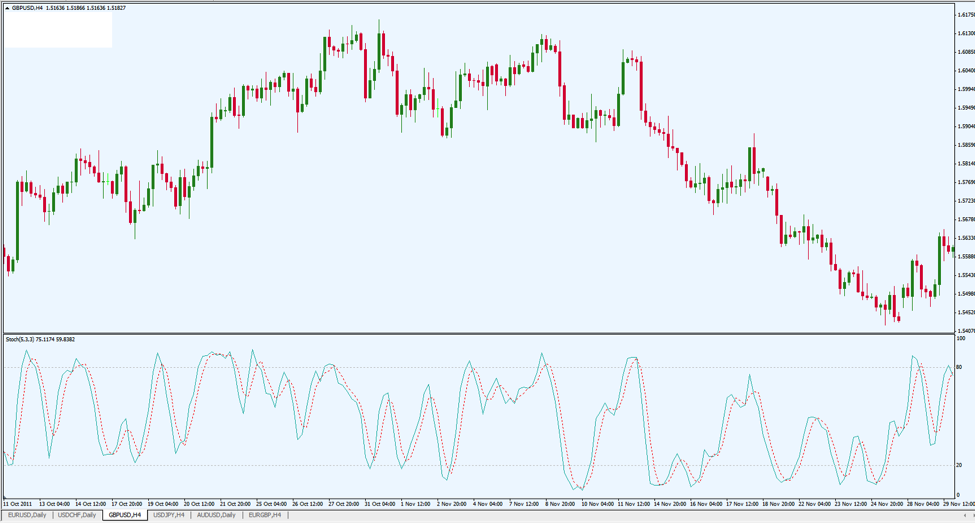

Another technical indicator that is largely unique to mutual use in the forex market is the Stochastics indicator. This technical tool is useful in determining when prices accept go inexpensive relative to the historical averages (oversold) or too expensive relative to the historical averages (oversold). Where Bollinger BAnds are plotted with price activity, the Stochastics indicator is plotted split up from the price activeness (below).

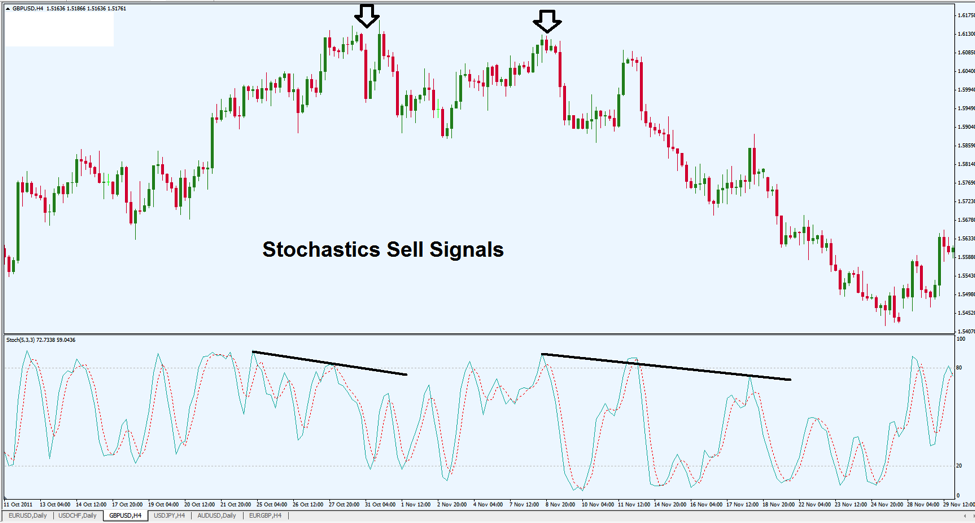

Let'southward take a look at a chart case using the GBP/USD:

Chart Source: Metatrader

As you can see, the Stochastics indicator is plotted on a graph from 0 to 100. Readings to a higher place the 80 mark qualify as overbought, while readings below the 20 marker suggest the currency pair is oversold. Overbought readings propose that traders should consider selling the currency pair, oversold readings indicate traders should consider buying the currency pair.

Adjacent, allow'due south await at some sell signals that were sent in this chart:

Chart Source: Metatrader

In this nautical chart, we can see a clear downtrend. But if nosotros look at the activity in the Stochastics readings, sell signals were sent early on. When we look at the oversold readings that start nigh the halfway point, nosotros tin see slowing momentum in the levels that were hit past the indicator. This weakening momentum (ie. the indicator is no longer able to reach the same highs) should take signals that forex traders could start to sell the currency pair, prior to the massive downtrend that followed.

Trade Management and Trailing Stop Losses

One of the biggest mistakes fabricated past new traders comes from the belief that one time you initiate a trade, the process and your work as a trader is over. Unfortunately, aught could be further from the truth. And if you neglect to actively manage your trades in one case they are placed, you will near certainly encounter unnecessary losses. The forex market is always moving and evolving, and in many cases the surroundings can change significantly after your merchandise is placed. For these reasons, there will be instances where traders will need to adjust their stop loss levels and profit targets. Hither, we look at some methods to manage your trades from a protective standpoint in adjusting your cease losses after the initial trade is executed.

Active Stop Management

On the positive side, if you are ready to conform your stop loss it probably ways that your position is gaining (in the coin). If the market was moving against you lot, your cease loss probable would have been hit on its own. Many traders will expect at trade management from a pip standpoint.

For instance, a trader might commencement to conform the stop once the trade is positive by 50 pips. 1 strategy in a situation like this is to take profits on one-half the position, and then moving the stop loss to the break even point (the price level at which the trade was opened). This method effectively allows traders to capture some profits while removing whatsoever potential for further gamble. If the terminate loss is hit later, no losses volition be seen.

In that location are other methods that follow the same general logic but do not rely on pip values. For instance, a trader might instead look at percentages as a mode of determining when a stop loss should be moved. If the trade has made gains of 1-two% it would generally be a practiced idea to start taking gamble off of the table and moving your terminate losses to the interruption even point. In any case, at that place is zilch wrong with taking profits on at least some portion of your trade. As the old forex markets maxim goes, "nobody e'er went broke taking trading gains."

Parabolic Stop and Reverse (SAR)

An alternative arroyo require more bent in technical assay. Here, we will introduce a less unremarkably used chart indicator called the Parabolic Stop and Reverse, or Parabolic SAR. The Parabolic SAR indicator is much easier to understand through visuals, so allow'south have await at the indicator at piece of work using the EUR/USD:

Chart Source: Metatrader

Visually, the Parabolic SAR looks similar no other indicator and it might even be a bit difficult to come across on the chart. Simply here we tin see purple dots that follow price activeness and send buying and selling signals in the process. Specifically, buy signals are sent when prices are above the plotted indicator reading. Sell signals are sent when prices are below the indicator reading.

But these signals tin can besides be used in positions that have already been established. For example, forex traders that are in active long positions might want to consider exiting those positions when sell signals are sent. Conversely, those in active brusque positions might want to consider reversing that stance if the indicator issues a buy signal. This is why the indicator is named the "cease and opposite."

Allow's look at this nautical chart again with the purchase and sell signals identified:

Chart Source: Metatrader

Here, we can see how it looks when the Parabolic SAR sends its buy and sell signals. Allow'south pay special attention to the first two signals. The start downward arrow signals an opportunity to sell the EUR/USD currency pair. Presume that this short position was taken and held until a buy point was sent at the 2d upward pointer. Here, a forex trader could have capitalized on a price move of roughly 600 pips before in that location was any indication that the position should be closed. If nosotros look at the differences between the second and tertiary signals (a buy betoken and a sell signal, respectively), an even larger movement is seen.

With this in mind, it should exist understood that the Parabolic SAR is a very powerful tool in terms of the ways it tin can permit traders to actively manage their positions once established.

Forex Breakouts

A large percentage of forex traders focus on technical analysis and use information technology as a basis for establishing new positions. To some extent, this makes a good deal of sense because analyzing the currency markets is a much broader task than analyzing the earnings outlook for a single visitor. Many more than factors influence the economical prospects for an entire nation, so one solution for dealing with this is to pay more attention to price charts and using that data to constitute forex trades.

There are many sub-strategies that forex traders use when attacking these markets, but ane of the most common is the breakout strategy. In this instance, forex traders look for chart signals which suggest that currency prices are on the verge of a big move (in either the upwards or downward direction). Here, we will look at some of the elements that go into spotting breakouts every bit well equally some of the trade management rules that are typically associated with this blazon of trading.

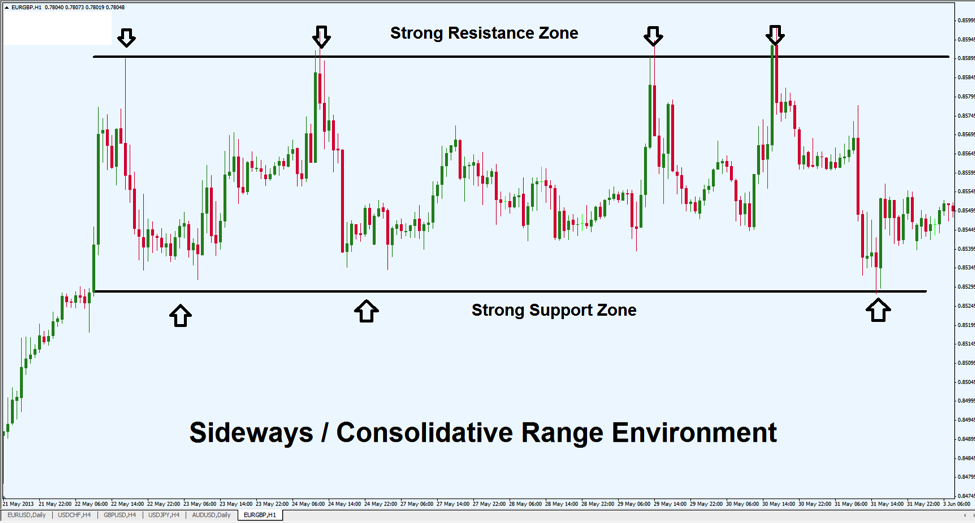

The End of a Sideways Market place

In order for a breakout to occur, we must first have a sideways, or consolidating, trading environs. Those familiar with some of the basics of technical analysis will sympathise the trading range — which is where prices bounce back and forth between support and resistance levels with no dominant trend in identify. Below is an example of a sideways market place with range trading characteristics present:

Chart Source: Metatrader

The in a higher place chart shows sideways trading activity in the EUR/GBP, which is a currency pair that is oftentimes caught in trading ranges. Prices bounce back and forth from the support zone to the resistance zone and no dominant trend is nowadays. Trading ranges cannot last forever, however, and once this trading range breaks down, there are increased for breakouts as the market adjusts to the new directional momentum.

Breakouts Signal New Trend Beginning

When one of these back up or resistance levels is breached, forex traders start to position for the beginning of a new trend. The logic here is that marketplace free energy was edifice as cost activity was constricting. Once these consolidative ranges break, the momentum that follows is often very forceful. When forex traders are able to spot these events in the early stages, significant profits can exist captured when new positions are established in the direction of the breakout.

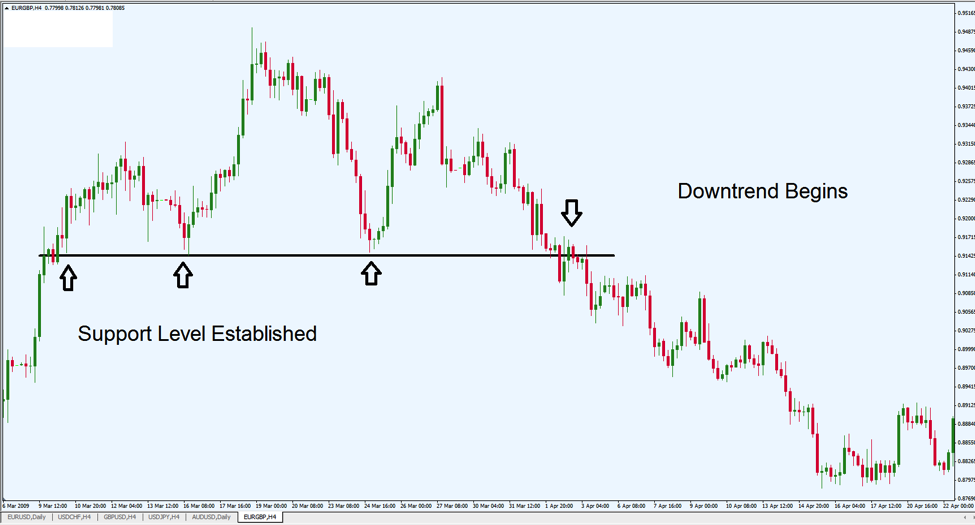

Permit'due south take a expect at a downside breakout in the EUR/GBP:

Chart Source: Metatrader

In the chart in a higher place, we tin see an example of a bearish breakout where prices are trading mostly sideways confronting a clearly defined level of support. In forex, breakout traders would be looking for an opportunity for new trades every bit the level of back up finally breaks. This effect occurs at the downside arrow, which comes in most the 0.9150 mark. Curt trades could take been taken here, and roughly 350 pips could have been captured as the GBP strengthened and prices before long vicious below 0.8800.

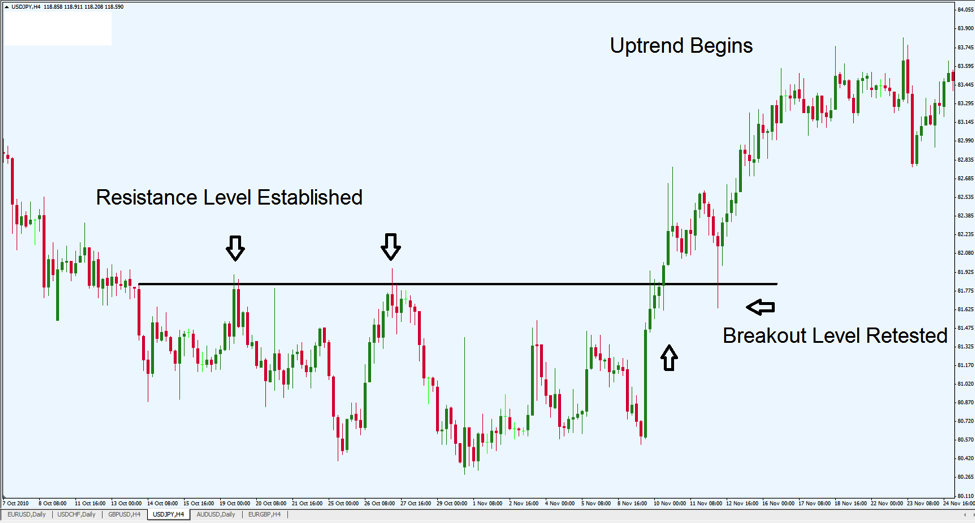

Next, let'southward assess a bullish example using the USD/JPY:

Chart Source: Metatrader

In the chart above, nosotros can see an example of a bullish breakout where prices are trading sideways against a conspicuously defined level of resistance. Here, breakout traders would be looking for an opportunity for long trades as the level of resistance finally breaks. This event occurs at the upside arrow, which comes in well-nigh the 81.eighty mark. Long trades could accept been taken here, and roughly 200 pips could have been captured as the USD strengthened and prices subsequently rose to the 83.80 region.

An added factor that can be seen in this example is the fact that prices pushed through the critical resistance zone, fabricated a minor rally — and then dropped back slightly to retest the expanse of the breakout. Basic technical analysis rules tell usa that once a level of resistance is cleaved, it then becomes a level of stiff support. (But as a broken level of support will and then go a level of stiff resistance). In this USD/JPY example, we tin can see that after the initial bullish breakout prices dropped to examination the 81.eighty breakout zone. This is shown at the cherry-red candle near the sideways arrow. The long bottom wick on this candle shows that prices bounced forcefully out of this area — strong indication that the breakout is valid and that 81.80 volition now be viewed equally support for the uptrend that follows.

Source: https://www.teachmetrading.com/forex/trading-forex-advanced/

Posted by: diggstagathe.blogspot.com

0 Response to "How Do You Know When To Buy Or Sell In Forex"

Post a Comment